You will need to know what education is required before you can apply for a Florida real-estate license. This article will provide information about the required education for pre-licensing, as well as the time commitment. We also explain how to maximize the benefits of this education. We'll also discuss which courses are the most important, and what you should expect to pay as a result.

Pre-licensing education

You must complete pre-licensing training before you can begin practicing real estate in Florida. To be eligible for a license, you will need to complete at least 63 credit hours of prelicensing education. These courses should include the law, mathematics, and principles of real estate practice. Some courses will cost anywhere from $100 to $500. The minimum passing score required to be licensed in Florida is 70 percent. Attorneys don't need to take pre-licensing classes. They can sit for the exam as a sales associate without a license.

Pre-licensing education for real property in Florida can be obtained online or in person through a number of companies. Many of these courses offer self-paced learning and practice exams. Other courses offer a range of study aids such as practice exams and books. No matter what your choice is, it's important to meet the state's pre-licensing requirements. There are several online programs that offer prelicensing education.

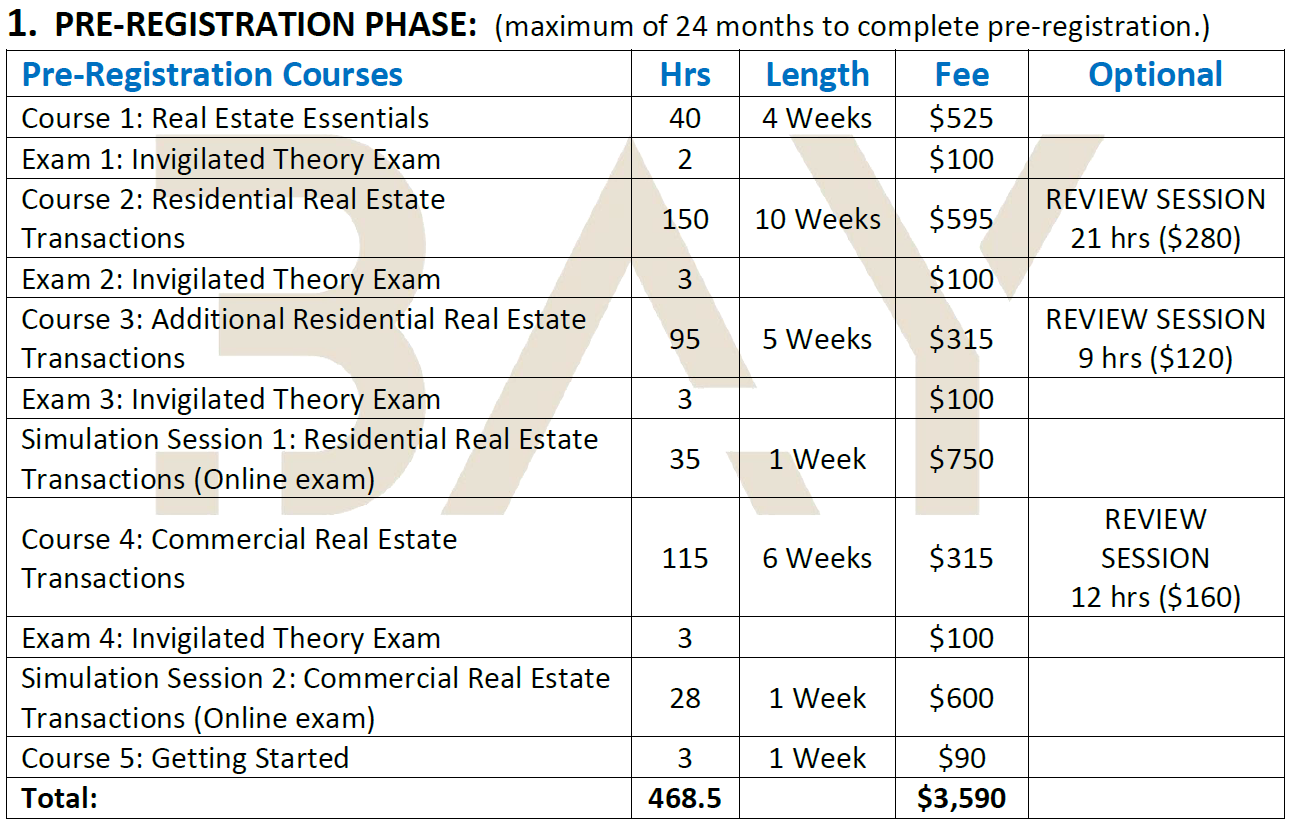

Cost of pre-licensing training

The cost of prelicensing education to become a real estate agent can vary depending on the state. There are many factors that can explain this. The most common reason is the time and effort required to create real estate courses. These courses must be produced by companies. They must pay staff to maintain the content current and meet state legal requirements. Some brokerages and title companies offer continuing education courses at no cost, but these courses are typically more extensive and longer than others.

No matter what state you are from, Florida real estate licensing education is well-worth the expense. A Florida real estate exam consists of 100 multiple-choice questions and the passing score is 75%. There are 45 questions that examine real estate law principles and 10 questions which test your mathematical knowledge. If you do your homework, you can expect to get a score of 75% and higher.

Time required to complete the pre-licensing educational program

An individual must be at least eighteen years of age and have passed a background check to get a Florida real estate license. They must have completed at most 90 hours of education before they can be licensed and take a six-hour course about contract writing. They must also be of good moral character. If they are convicted of any felony, they won't be considered for a licensed real estate agent. It is necessary to have fingerprint clearance. They must then be approved by their Broker online, and then complete their continuing education requirements.

All applicants must be at minimum 18 years of age with a US social security number. Candidates must also have a high-school diploma. Real estate education is not necessary in Florida. However, having the right foundation can help you learn the ropes. Florida recognizes licenses from a few states, including Nebraska, Arkansas, Georgia, Illinois, and Arkansas. Applicants are eligible to get a license in Florida if they have a real estate license from any of these states. Candidates from Arkansas and Connecticut, Georgia, Illinois, or Connecticut will also need to pass the state exam.

FAQ

Is it possible to get a second mortgage?

Yes. However, it's best to speak with a professional before you decide whether to apply for one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

How do I calculate my interest rate?

Market conditions affect the rate of interest. The average interest rate during the last week was 4.39%. Multiply the length of the loan by the interest rate to calculate the interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

Do I require flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance helps protect your belongings, and your mortgage payments. Learn more about flood insurance here.

How long does it take for my house to be sold?

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It can take from 7 days up to 90 days depending on these variables.

Can I buy a house without having a down payment?

Yes! There are many programs that can help people who don’t have a lot of money to purchase a property. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. For more information, visit our website.

Statistics

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to buy a mobile home

Mobile homes are houses built on wheels and towed behind one or more vehicles. Mobile homes are popular since World War II. They were originally used by soldiers who lost their homes during wartime. People who want to live outside of the city are now using mobile homes. Mobile homes come in many styles and sizes. Some houses have small footprints, while others can house multiple families. There are some even made just for pets.

There are two types of mobile homes. The first type is produced in factories and assembled by workers piece by piece. This takes place before the customer is delivered. The other option is to construct your own mobile home. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. Next, ensure you have all necessary materials to build the house. Finally, you'll need to get permits to build your new home.

If you plan to purchase a mobile home, there are three things you should keep in mind. You might want to consider a larger floor area if you don't have access to a garage. A larger living space is a good option if you plan to move in to your home immediately. Third, you'll probably want to check the condition of the trailer itself. Problems later could arise if any part of your frame is damaged.

Before buying a mobile home, you should know how much you can spend. It is important that you compare the prices between different manufacturers and models. It is important to inspect the condition of trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

It is possible to rent a mobile house instead of buying one. Renting allows the freedom to test drive one model before you commit. Renting isn't cheap. Most renters pay around $300 per month.