There are many ways that real estate agents get paid, depending on their circumstances. The commission paid to a realtor and a percentage of the sale prices are the most common. These commissions are typically split between the listing broker and the buyer's representative. A realtor's fee may be fixed or negotiated with a seller.

The most common way to pay a realtor is to have them charge a percentage of the sale price. This is called a commission, and is often a percentage of the final purchase price, which can vary from a few hundred dollars to several thousands of dollars. Most sellers will pay between 5-6 percent. It all depends on the local market. Real estate agents may earn higher commissions in some neighborhoods than in others.

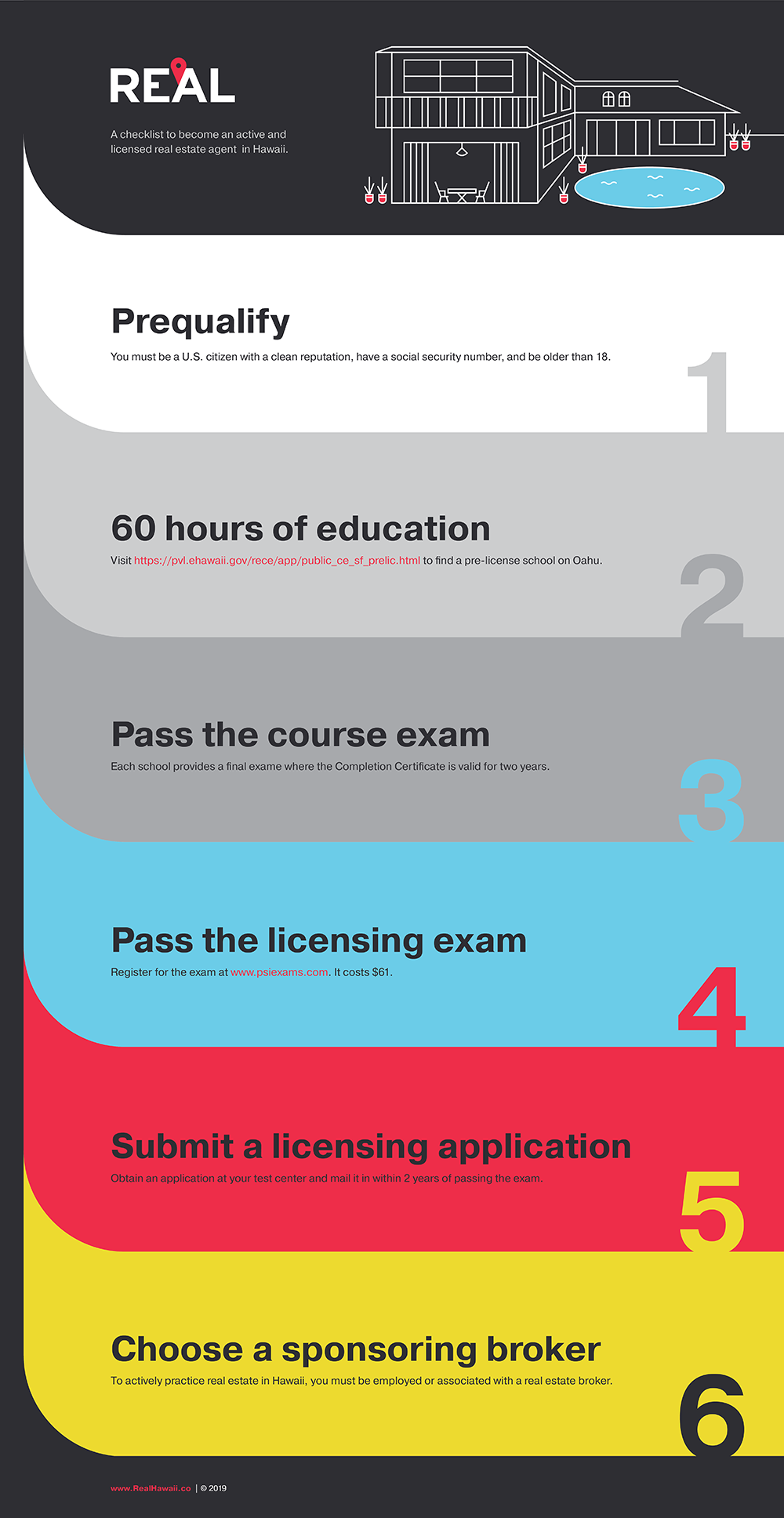

There are many ways you can get paid to be a realtor. Some agents work as independent contractors while others are employed by brokerage firms. You should understand the responsibilities of becoming a real estate agent before you make the plunge. You'll have to be ready for some long hours and a bit of competition.

You can get a free estimate of the home's value to find out how much a real estate agent makes. To figure out how much money you'll make, you'll need an estimate of the home's worth, including its closing costs and taxes.

The average annual salary of a realtor in the United States is $44,000. It may seem like a lot but many realtors are actually earning more than a full-time income. Experience is key to earning more money. A new agent typically earns a base salary in excess of tens and thousands, plus a small commission.

Agents will often charge a commission because real estate requires a lot more effort. However, the commission is split between the realtor and their client. You can ask the seller to cover marketing costs if you are purchasing a house.

Flat fee, or "finder's fees", is one of the latest trends in real estate. This arrangement often saves sellers nineteen thousand dollars. A percentage-based fee is another option that can help you earn a bonus if you sell your home for more than you are currently paying.

A real estate agent is responsible for selling buyers and sellers, in addition to earning you a good chunk of cash. A realtor, among other responsibilities, will sign the contract, prepare the documents, and update the status of a property when it goes under contract.

It is important you are aware that you will need to pay a lot of fees before moving into your new home. These fees can add up quickly. You can avoid most of these costs by working with an Escrow Company. An escrow firm will hold your funds until the transaction closes. Then, the remaining funds will be given to the companies using your agent.

FAQ

Can I afford a downpayment to buy a house?

Yes! Yes. There are programs that will allow those with small cash reserves to purchase a home. These programs include government-backed mortgages (FHA), VA loans and USDA loans. You can find more information on our website.

What are the pros and cons of a fixed-rate loan?

Fixed-rate mortgages guarantee that the interest rate will remain the same for the duration of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans offer lower payments due to the fact that they're locked for a fixed term.

How much money will I get for my home?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com shows that the average home sells for $203,000 in the US. This

What should I consider when investing my money in real estate

It is important to ensure that you have enough money in order to invest your money in real estate. You can borrow money from a bank or financial institution if you don't have enough money. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should include mortgage payments, taxes, insurance and maintenance costs.

You must also ensure that your investment property is secure. It would be a good idea to live somewhere else while looking for properties.

What are some of the disadvantages of a fixed mortgage rate?

Fixed-rate loans have higher initial fees than adjustable-rate ones. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Do I need to rent or buy a condo?

Renting might be an option if your condo is only for a brief period. Renting allows you to avoid paying maintenance fees and other monthly charges. On the other hand, buying a condo gives you ownership rights to the unit. You have the freedom to use the space however you like.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

External Links

How To

How to Manage A Rental Property

You can rent out your home to make extra cash, but you need to be careful. This article will help you decide whether you want to rent your house and provide tips for managing a rental property.

Here are some things you should know if you're thinking of renting your house.

-

What is the first thing I should do? Before you decide if your house should be rented out, you need to examine your finances. If you are in debt, such as mortgage or credit card payments, it may be difficult to pay another person to live in your home while on vacation. Your budget should be reviewed - you may not have enough money to cover your monthly expenses like rent, utilities, insurance, and so on. You might find it not worth it.

-

How much is it to rent my home? Many factors go into calculating the amount you could charge for letting your home. These factors include your location, the size of your home, its condition, and the season. You should remember that prices are subject to change depending on where they live. Therefore, you won't get the same rate for every place. The average market price for renting a one-bedroom flat in London is PS1,400 per month, according to Rightmove. This means that you could earn about PS2,800 annually if you rent your entire home. While this isn't bad, if only you wanted to rent out a small portion of your house, you could make much more.

-

Is it worth it? There are always risks when you do something new. However, it can bring in additional income. Before you sign anything, though, make sure you understand exactly what you're getting yourself into. You will need to pay maintenance costs, make repairs, and maintain the home. Renting your house is not just about spending more time with your family. These are important issues to consider before you sign up.

-

Is there any benefit? Now that you have an idea of the cost to rent your home, and are confident it is worth it, it is time to consider the benefits. There are plenty of reasons to rent out your home: you could use the money to pay off debt, invest in a holiday, save for a rainy day, or simply enjoy having a break from your everyday life. It is more relaxing than working every hour of the day. If you plan well, renting could become a full-time occupation.

-

How do I find tenants? After you have decided to rent your property, you will need to properly advertise it. Make sure to list your property online via websites such as Rightmove. You will need to interview potential tenants once they contact you. This will help you evaluate their suitability as well as ensure that they are financially secure enough to live in your home.

-

How can I make sure I'm covered? If you don't want to leave your home empty, make sure that you have insurance against fire, theft and damage. Your landlord will require you to insure your house. You can also do this directly with an insurance company. Your landlord will usually require you to add them as additional insured, which means they'll cover damages caused to your property when you're present. However, this doesn't apply if you're living abroad or if your landlord isn't registered with UK insurers. In this case, you'll need to register with an international insurer.

-

If you work outside of your home, it might seem like you don't have enough money to spend hours looking for tenants. However, it is important that you advertise your property in the best way possible. A professional-looking website is essential. You can also post ads online in local newspapers or magazines. Additionally, you'll need to fill out an application and provide references. While some people prefer to handle everything themselves, others hire agents who can take care of most of the legwork. In either case, be prepared to answer any questions that may arise during interviews.

-

What should I do after I have found my tenant? If you have a contract in place, you must inform your tenant of any changes. You can negotiate details such as the deposit and length of stay. While you might get paid when the tenancy is over, utilities are still a cost that must be paid.

-

How do I collect rent? When the time comes for you to collect the rent you need to make sure that your tenant has been paying their rent. If they haven't, remind them. You can deduct any outstanding payments from future rents before sending them a final bill. You can call the police if you are having trouble getting hold of your tenant. They will not usually evict someone unless they have a breached the contract. But, they can issue a warrant if necessary.

-

How can I avoid problems? It can be very lucrative to rent out your home, but it is important to protect yourself. Ensure you install smoke alarms and carbon monoxide detectors and consider installing security cameras. Also, make sure you check with your neighbors to see if they allow you to leave your home unlocked at night. You also need adequate insurance. Finally, you should never let strangers into your house, even if they say they're moving in next door.