There is increasing debate over whether you need to have a college diploma in order be a real-estate agent. Many people believe that a degree will allow you to earn more money and work less, while others think that it will take up more of your time. While both sides are correct in some aspects, there may also be many benefits to a college-level degree that outweighs the cost and time.

The realty industry is very competitive. Being educated will increase your chances of success. A degree can help you understand the business better and allow you to make informed decisions about properties and mortgages.

You can earn a real estate agent college degree to prepare you for a job as an appraiser, loan officer, broker or property manager. These positions require a bachelor’s in real estate and knowledge of the realty market.

You'll learn how to research and analyze the market in order to create a strategy that your clients will be more likely to find their next home. You will be able to increase your sales and keep your clients coming back to you for more advice.

Some colleges offer specific majors in the real estate industry, so you can choose a program that best fits your goals and interests. Communications might be an option for someone who is interested in marketing or sales. Another option is a degree in finance that teaches you how grow and manage businesses.

The mobile nature of the real estate industry means you can work from anywhere in America. This can be huge for some people because they don’t want to be tied down in one area.

Regardless of your choice, it's important to remember that the only way to make money in this profession is to sell homes. To become a great agent and grow your network of sellers and buyers, you must work hard.

A lot of paperwork is required for a real estate agent. You will need to make offers on homes, take photographs of them, record information about the houses and answer any questions they may have.

It is important to understand the laws that govern real estate so that you can provide your clients with accurate and reliable information. You will also need to follow your state's regulations and be aware of any changes in the laws that might affect your clients.

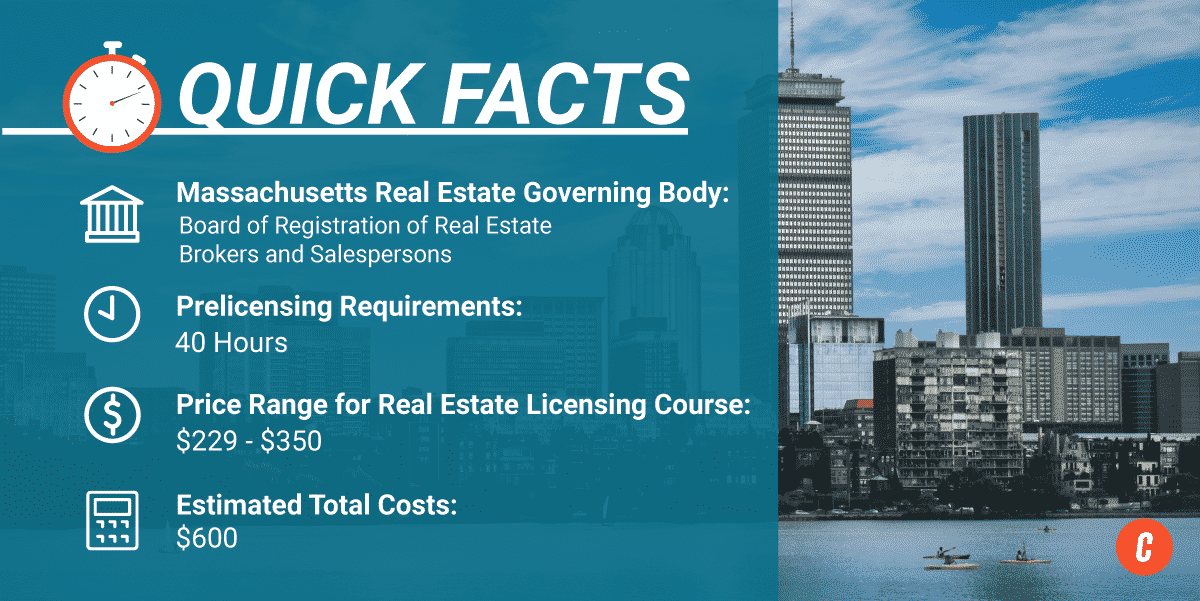

A few courses are required before you can obtain your agent license. In most cases, you must pass a test. These courses are known as prelicense courses. They cover topics such as working with clients, negotiating, closing deals, and following real estate law.

FAQ

What are the most important aspects of buying a house?

The three most important factors when buying any type of home are location, price, and size. The location refers to the place you would like to live. Price refers to what you're willing to pay for the property. Size refers to how much space you need.

How can I calculate my interest rate

Market conditions affect the rate of interest. The average interest rate during the last week was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example, if $200,000 is borrowed over 20 years at 5%/year, the interest rate will be 0.05x20 1%. That's ten basis points.

Should I use an mortgage broker?

Consider a mortgage broker if you want to get a better rate. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. Before signing up for any broker, it is important to verify the fees.

Can I afford a downpayment to buy a house?

Yes! Yes! There are many programs that make it possible for people with low incomes to buy a house. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. For more information, visit our website.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to locate an apartment

When moving to a new area, the first step is finding an apartment. This process requires research and planning. This involves researching and planning for the best neighborhood. While there are many options, some methods are easier than others. Before renting an apartment, you should consider the following steps.

-

Online and offline data are both required for researching neighborhoods. Online resources include Yelp. Zillow. Trulia. Realtor.com. Local newspapers, landlords or friends of neighbors are some other offline sources.

-

Review the area where you would like to live. Review sites like Yelp, TripAdvisor, and Amazon have detailed reviews of apartments and houses. You can also find local newspapers and visit your local library.

-

Call the local residents to find out more about the area. Talk to those who have lived there. Ask them about their experiences with the area. Ask for recommendations of good places to stay.

-

You should consider the rent costs in the area you are interested. Consider renting somewhere that is less expensive if food is your main concern. Consider moving to a higher-end location if you expect to spend a lot money on entertainment.

-

Find out about the apartment complex you'd like to move in. For example, how big is it? What price is it? Is it pet friendly What amenities do they offer? Do you need parking, or can you park nearby? Are there any special rules for tenants?