In Minnesota, you can get a real estate license by meeting certain requirements. Minnesota Commerce Department wants to ensure that all real estate agents are licensed and competent to work in the state. The requirements include being at least eighteen years old and U.S. citizens or lawfully admitted aliens. While citizenship is not an issue for most users it can lead to denial of a license if there are any criminal records, unpaid judgements or disciplinary actions against professional licenses. You should also be aware that you can't get a license for unlicensed real property activity.

Pre-license education

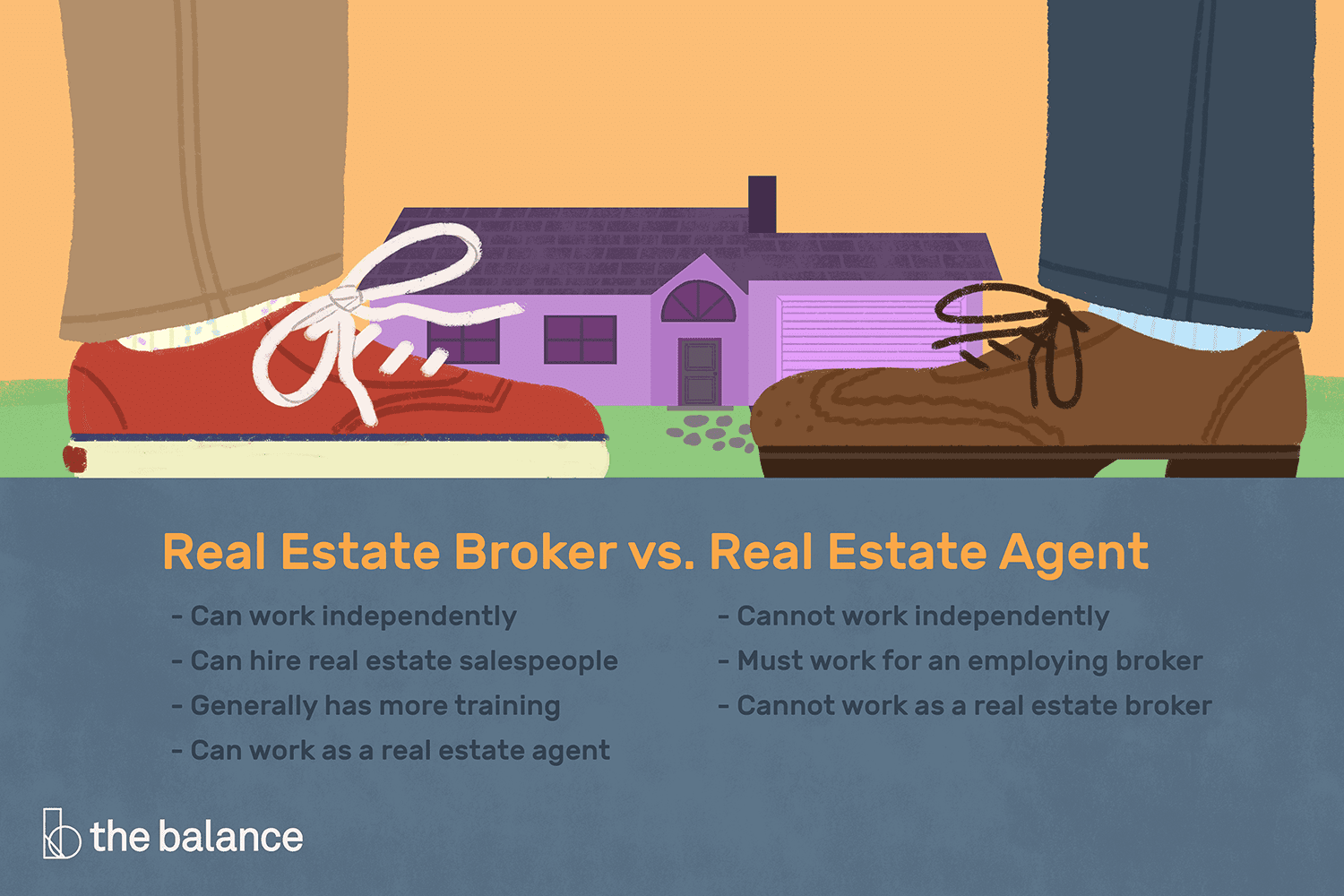

Pre-license training is an important part in becoming a Minnesota licensed real estate agent. It can help increase your chances of passing the exam and avoiding retaking it. Minnesota requires you to be licensed as a real agent within four months. The licensing process depends on completing the pre-license education course, passing the exam and being sponsored by a licensed brokerage.

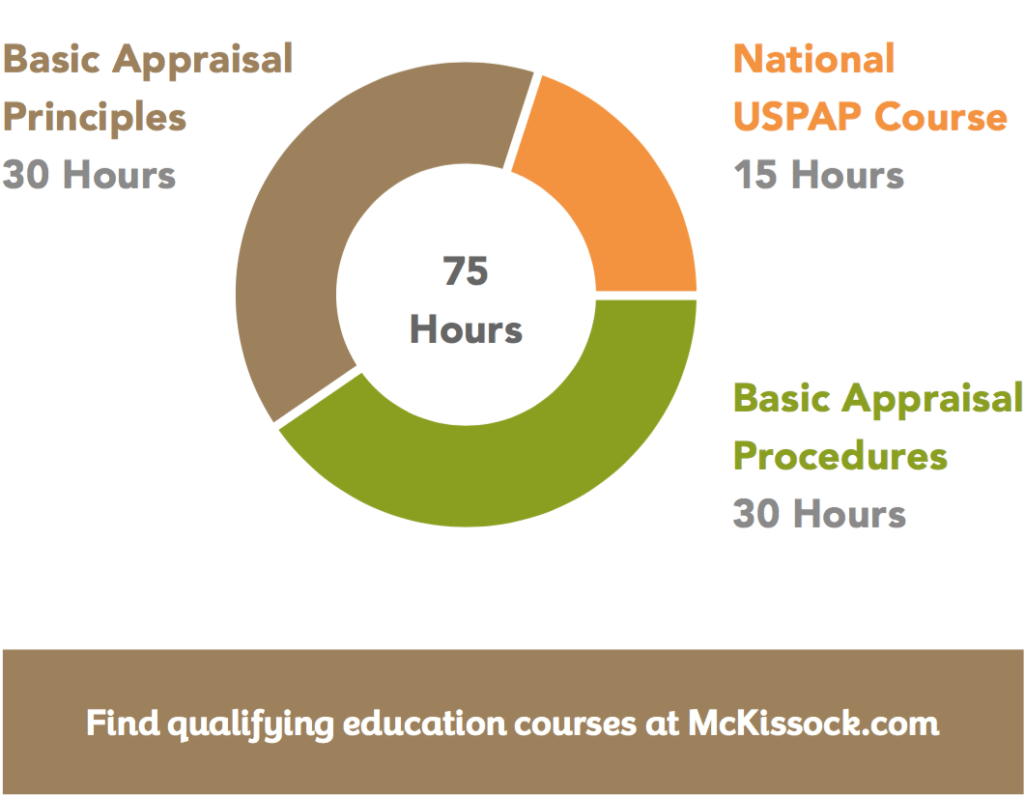

Pre-license online courses are a great way for you to start your education towards your Minnesota realty license. There are three courses of 30 hours that can help you earn your license. These courses cover topics like valuation, financing, contracts and real estate principles. Online courses are available through providers such as ContinuingEd Express. They offer live streaming as well as online courses.

Education requirements for continuing education

Minnesota real estate agents must complete at minimum fifteen hours of continuing education every year. Over a two-year period, that's 30 hours. There are several ways to earn the required real-estate CE. These include online classes, webinars on demand, and live courses. Kaplan offers live and on-demand courses to meet the state's continuing education requirements. Kaplan's online courses are approved for 3.75 hours of real estate CE and can also qualify for fair housing and agency credit.

Minnesota Real Estate Commission adopted a new system of real estate CE credit. This means that real-estate licensees must complete a minimum of eight hours of continuing education within a single day but not more than 15 hours over a 24-hour period. To meet Minnesota's continuing educational requirements, salespeople and brokers must complete a prelicensing CE course each year. These courses offer 3.75 hours of CE credit, and they must be completed before June 30, 2022. You can also take the course online, even if you don't have a live instructor. While most courses can be completed on your own, some are streamed live. Exam prep courses cover both national and state sections of the Minnesota licensing exam.

Exam

Minnesota requires that you pass an exam to obtain a license to sell real estate. This is a process that ensures the public's safety by verifying the person has the required competence. The examination is used to determine if an individual follows the state's safe practice standard. The Minnesota real estate licensing examination is administered by Pearson VUE.

Minnesota's real estate license requires that applicants have successfully completed both a prelicense education program and passed the state exam. The state requires that applicants are at least 18 years of age and a legal permanent resident of the United States. Minnesota has reciprocity agreements with several other states, including Wisconsin. Minnesota does not require you to take a prelicensing program if you are a licensed agent from a reciprocal state. The PULSE Portal allows you to apply online and send a letter attesting to your current license. You will also be able pass the state section of the exam. In Wisconsin, however, you must take a 13-hour Wisconsin-to-Minneseta prelicensing course.

Prices

You must first obtain a Minnesota license to be a real-estate agent. You can complete the entire process online with the exception that you must take the exam in person. This article will explain the process in detail, including what it will cost and how long it takes. We will also talk about the exam content and offer some resources for further information.

The state of Minnesota requires that all real estate agents complete at least 90 hours of pre-licensing education. These courses can be taken online or in a classroom setting. The cheapest option is the online on-demand course. A typical package will include three courses. These typically cost between $200 and $300.

FAQ

How long does it take to get a mortgage approved?

It all depends on your credit score, income level, and type of loan. Generally speaking, it takes around 30 days to get a mortgage approved.

What should you look out for when investing in real-estate?

The first thing to do is ensure you have enough money to invest in real estate. If you don’t save enough money, you will have to borrow money at a bank. Also, you need to make sure you don't get into debt. If you default on the loan, you won't be able to repay it.

You also need to make sure that you know how much you can spend on an investment property each month. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

Finally, ensure the safety of your area before you buy an investment property. It would be best if you lived elsewhere while looking at properties.

What should I do before I purchase a house in my area?

It depends on how much time you intend to stay there. Save now if the goal is to stay for at most five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

How can I eliminate termites & other insects?

Over time, termites and other pests can take over your home. They can cause serious destruction to wooden structures like decks and furniture. To prevent this from happening, make sure to hire a professional pest control company to inspect your home regularly.

What are the benefits to a fixed-rate mortgage

A fixed-rate mortgage locks in your interest rate for the term of the loan. This means that you won't have to worry about rising rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

Can I get a second loan?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

Statistics

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Rent a House

For people looking to move, finding houses to rent is a common task. However, finding the right house may take some time. When you are looking for a home, many factors will affect your decision-making process. These factors include location, size and number of rooms as well as amenities and price range.

It is important to start searching for properties early in order to get the best deal. Ask your family and friends for recommendations. This will ensure that you have many options.