A great way to diversify portfolio is to invest in property outside your home state. You can lower your risk while increasing your ROI by buying properties in diverse markets. It is important to weigh all aspects before you make this purchase.

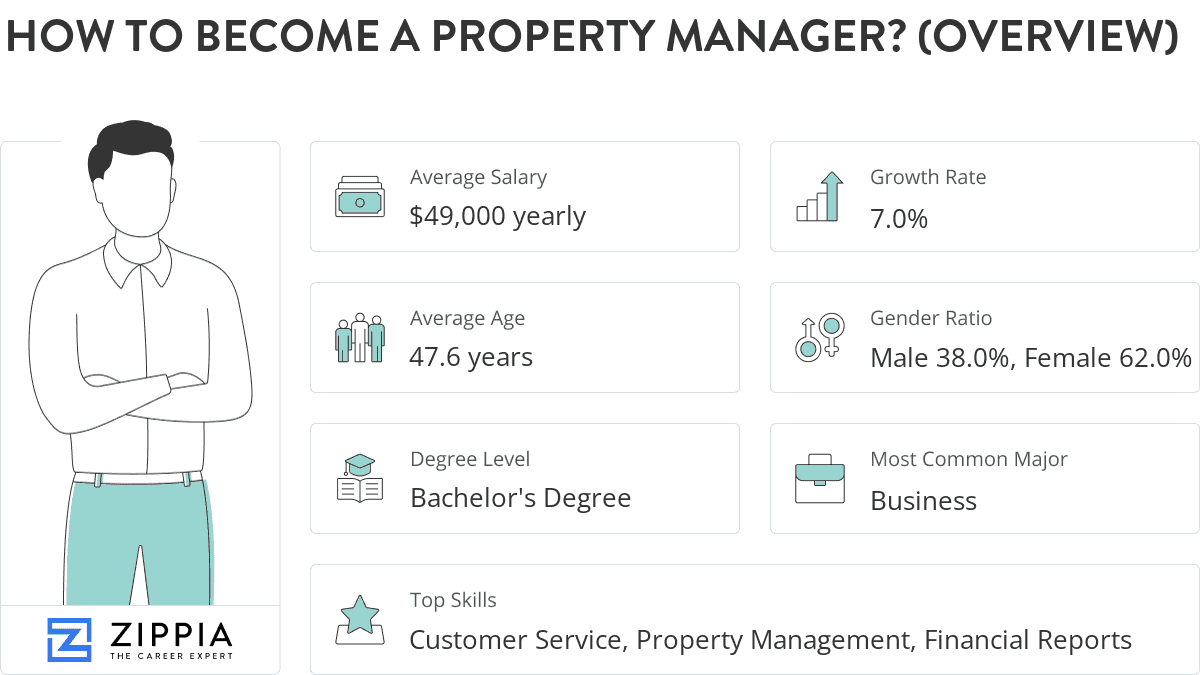

Purchasing property out of state is a great option for people who are looking to buy rental properties, but do not want to be involved in all the day-to-day responsibilities that come with being a landlord. Many people hire property managers to manage their investments and maximize their cash flow.

Roofstock provides information on the market to help you determine where your out-of state investment property is. The site provides information on the area's rental prices and appreciation rates. This site also allows you to look at other factors that can be important when investing in out-of state rental properties, such as the growth of the population and job opportunities.

When it comes to investing in out-of-state real estate, a vibrant market is important. You should search for areas that are highly sought after and have high appreciation rates. This will increase your ROI and help ensure that your out-of state rental property appreciates quickly.

Another important thing to consider when buying out of state property is your financial situation and whether or not you can afford the costs associated with owning a rental property in a different state. Consult with an experienced agent to ensure you are not putting too much cash down on property. This can impact your ability and financial situation to pay back the mortgage.

The best reason to invest in real estate outside of your home state is the possibility of a greater return than what you would get from buying property in your hometown. This can be due in part to higher housing prices, lower taxes, and higher appreciation rate in other areas.

Other benefits include the ability to rent out or sell your property on an out-of-state market to tourists looking to vacation in that area. This can be especially helpful if you live in an expensive state or are planning to retire early and want to use your house as a vacation home.

A real estate syndicate is another option. This allows you to pool your resources and take advantage of state investments. These large real property assets are often purchased by a group.

Most people decide to invest in real estate outside their home state because it is more affordable than buying property in their local market. This is especially true if you live in areas with high housing prices and difficult financing.

FAQ

What should you look out for when investing in real-estate?

The first step is to make sure you have enough money to buy real estate. If you don't have any money saved up for this purpose, you need to borrow from a bank or other financial institution. It is also important to ensure that you do not get into debt. You may find yourself in defaulting on your loan.

It is also important to know how much money you can afford each month for an investment property. This amount should include mortgage payments, taxes, insurance and maintenance costs.

It is important to ensure safety in the area you are looking at purchasing an investment property. It would be best if you lived elsewhere while looking at properties.

What is the cost of replacing windows?

Window replacement costs range from $1,500 to $3,000 per window. The exact size, style, brand, and cost of all windows replacement will vary depending on what you choose.

What is the maximum number of times I can refinance my mortgage?

This will depend on whether you are refinancing through another lender or a mortgage broker. You can refinance in either of these cases once every five-year.

Is it possible sell a house quickly?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. However, there are some things you need to keep in mind before doing so. First, you need to find a buyer and negotiate a contract. Second, you need to prepare your house for sale. Third, you need to advertise your property. You must also accept any offers that are made to you.

Can I get another mortgage?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

How can I calculate my interest rate

Market conditions can affect how interest rates change each day. The average interest rate over the past week was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

What time does it take to get my home sold?

It all depends upon many factors. These include the condition of the home, whether there are any similar homes on the market, the general demand for homes in the area, and the conditions of the local housing markets. It may take up to 7 days, 90 days or more depending upon these factors.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to find an apartment?

When moving to a new area, the first step is finding an apartment. Planning and research are necessary for this process. It includes finding the right neighborhood, researching neighborhoods, reading reviews, and making phone calls. While there are many options, some methods are easier than others. Before renting an apartment, you should consider the following steps.

-

Data can be collected offline or online for research into neighborhoods. Online resources include Yelp and Zillow as well as Trulia and Realtor.com. Offline sources include local newspapers, real estate agents, landlords, friends, neighbors, and social media.

-

See reviews about the place you are interested in moving to. Yelp and TripAdvisor review houses. Amazon and Amazon also have detailed reviews. You can also check out the local library and read articles in local newspapers.

-

Make phone calls to get additional information about the area and talk to people who have lived there. Ask them about what they liked or didn't like about the area. Ask for their recommendations for places to live.

-

Consider the rent prices in the areas you're interested in. If you are concerned about how much you will spend on food, you might want to rent somewhere cheaper. If you are looking to spend a lot on entertainment, then consider moving to a more expensive area.

-

Find out all you need to know about the apartment complex where you want to live. How big is the apartment complex? What's the price? Is it pet-friendly What amenities does it have? Are you able to park in the vicinity? Do you have any special rules applicable to tenants?