If you plan to list your home "For Sale by Owner", you might be wondering about the buyer's agency commission in your region. This can be a tricky question because the actual commission you will pay can vary widely. In general, however, the percentage you pay will be a percentage. The commission usually amounts to between five and six per cent of the sale price.

Before agreeing to your commission, it is important that you review the terms in your listing agreement. Typically, the commission is paid to the seller's broker, who will then split it with the buyer's agent. Some agents may receive more than one split.

Consider the many benefits of using a buyer’s representative. They can help you sell your home, and they can also show you the latest homes available in your target market. You may also need a buyer's advocate to assist you in the closing process. A buyer's agent can help arrange termite inspections. They can even negotiate on your behalf.

If you decide to use a real estate agent, make sure to read up on the advantages of working with a professional. It is important to ensure that you are working with an experienced and reputable real estate agent who can help you navigate the selling and buying process. Many agents have the ability to access financial and legal experts to assist them in negotiating and dealing with the title company.

You may get some tips from your agent about how to cut down on the buyer's agent commission. One option is to choose an agent who will charge you a flat rate for listing your property. This will reduce the commission by half. This will allow you to determine how much each individual service is worth in your region.

Your commission from an agent may be very low depending on where you reside. In fact, there are laws in some cities that require sellers to pay their buyer’s agent at least 0.1%. Others, such as Westchester County (New York), have a lower rate. Still, if your broker gives you a good deal, you can't complain.

Even if you are working with an agent, you still need to thoroughly analyze the value of your property. The quality of your marketing and your location will determine whether or not you are able to fetch the highest price for your property. To get the best deal, you can always contact a local real estate lawyer for a title search and an appraisal of your home.

A buyer's agent is also helpful when it comes time to secure financing. Although lenders don't usually allow home buyers to pay termite inspections, a real agent can make arrangements. Besides, a buyer's agent can provide a variety of other valuable services, such as doing a market analysis.

Remember that a buyer's agency commission cannot be cancelled after you have signed a purchase contract. If you find someone who is serious enough about buying your home, you won't be required to pay the commission.

FAQ

What are the cons of a fixed-rate mortgage

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. You may also lose a lot if your house is sold before the term ends.

What should you think about when investing in real property?

You must first ensure you have enough funds to invest in property. If you don’t save enough money, you will have to borrow money at a bank. Aside from making sure that you aren't in debt, it is also important to know that defaulting on a loan will result in you not being able to repay the amount you borrowed.

It is also important to know how much money you can afford each month for an investment property. This amount should cover all costs associated with the property, such as mortgage payments and insurance.

Also, make sure that you have a safe area to invest in property. It would be best if you lived elsewhere while looking at properties.

What is the maximum number of times I can refinance my mortgage?

It all depends on whether your mortgage broker or another lender is involved in the refinance. You can refinance in either of these cases once every five-year.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

External Links

How To

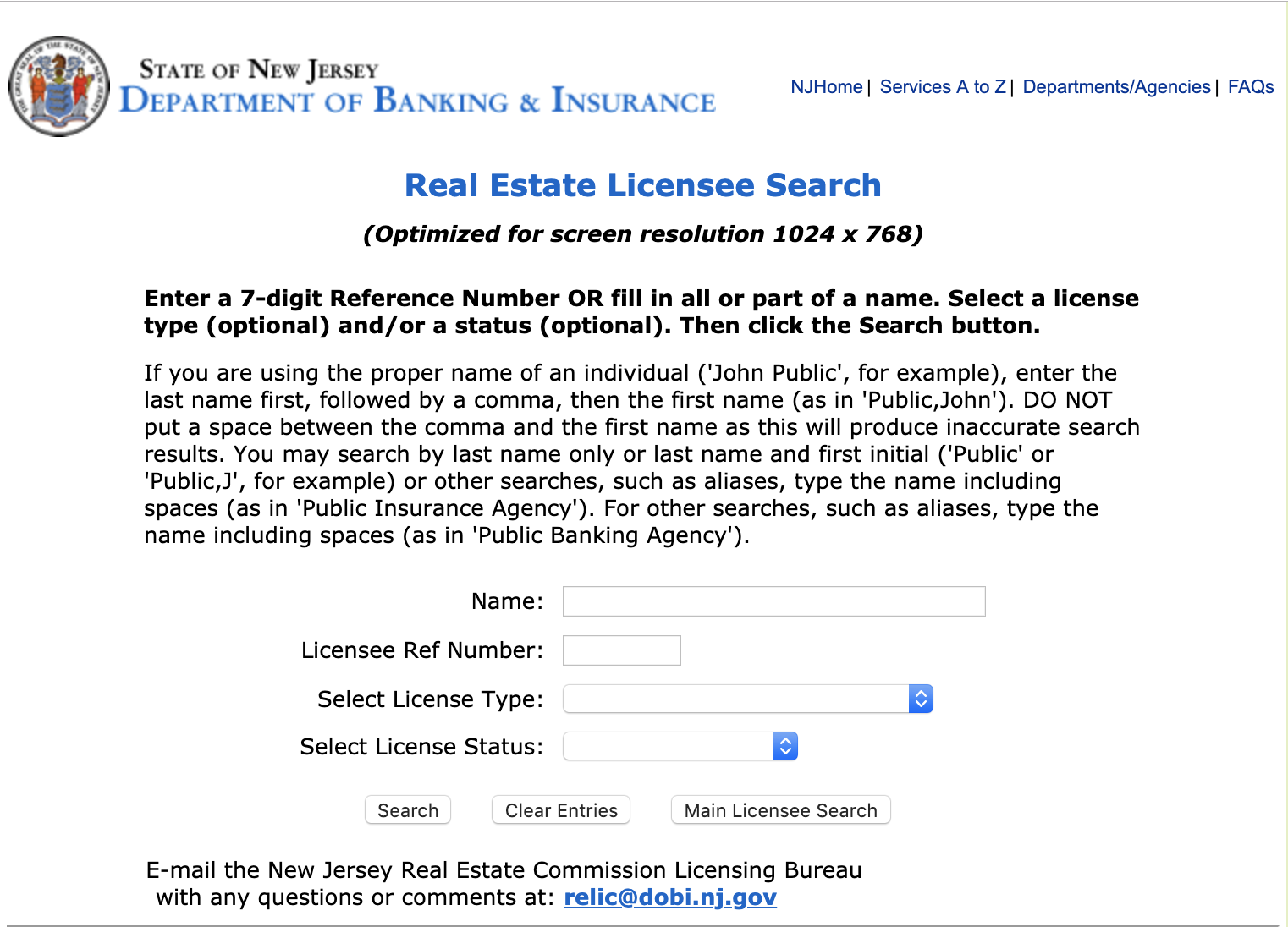

How to become an agent in real estate

To become a real estate agent, the first step is to take an introductory class. Here you will learn everything about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This involves studying for at least 2 hours per day over a period of 3 months.

Once this is complete, you are ready to take the final exam. To be a licensed real estate agent, you must achieve a minimum score of 80%.

If you pass all these exams, then you are now qualified to start working as a real estate agent!